OK. You’ve began researching for a mortgage, and what’s the first thing you do? You Google – best rate “fill in the blank of the town where you hope to live”. Up pops RBC, HSBC, Ratehub.ca amongst many other lenders in the industry. But one crucial factor that you may not have considered is that there’s a many different mortgage rates for a heck of a lot of different mortgage amounts. Therefore let me guide you through the process, and explain the difference of rates offered in order to help you become a rate searching Guru. Previously the mortgage industry had high ratio vs conventional mortgages, now there’s; insured, insurable and uninsurable.

High ratio mortgage is a down payment less than 20% and the insurance paid by the borrower (you).

Conventional mortgage is a down payment of 20% or more and the lender had a choice whether to insure the mortgage or not.

vs

Insured is a mortgage transaction where the insurance premium is or has been paid by the client (you). Generally, this means you put less than 20% down.

Insurable is a mortgage transaction that the lender pays for the mortgage insurance, the property is valued at less than $1MM and is qualified at the Bank of Canada benchmark rate, 25 year amortization with a down payment of at least 20%.

Uninsurable is defined as a mortgage transaction that is ineligible for insurance. Some examples of uninsurable mortgages are re-finances, purchases, transfers, 1-4 unit rentals (single unit Rentals—Rentals Between 2-4 units are insurable), properties valued at greater than $1MM, (re-finances are not insurable) equity take-out greater than $200,000, and amortization greater than 25 years.

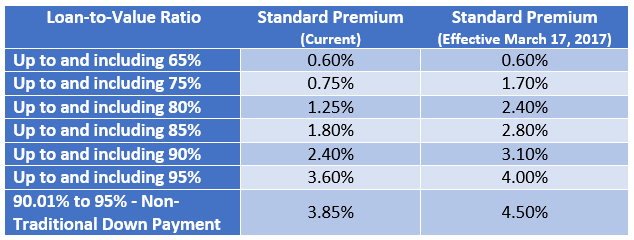

The biggest difference where you the mortgage consumer are feeling the effect is dum dum dum…. the interest rate. INSURED mortgage products are offered at a lower interest rate than the INSURABLE and UNINSURABLE products, and can differ between 0.20-0.40%. Why? Because of the insurance premium increase that took effect March 17, 2017 that you’ll have to pay. By the Federal Government limiting the way lenders could insure their book-of-business meant the lenders had to increase the cost. We as consumers pay for that increase. Here are the mortgage insurance premiums you pay for putting less than 20% down.

Insurance premiums were introduced for a few reasons; to protect the lenders against foreclosure, fraudulent activity and subject property value loss. The INSURED borrower’s mortgages have the insurance built in whereas INSURABLE and UNINSURABLE mortgages it’s the borrower that pays a higher interest rate which enables the lender to essential build in their own insurance premium. Lenders are in the business of lending money, and minimizing their exposure to risk. The insurance protects them from potential future loss.

The average size mortgage in BC is around $350,000, and lets say you put 5% down. Yes you’d get the lowest interest rate that you googled online, but you’d pay an extra $14,000 in mortgage insurance in order to do so. To summerize – The lowest rate comes with a price tag.

Hopefully this article highlights that it’s not about the lowest rate available. There’s many differnt rates for many different scenerio’s. Speak with a Mortgage Professional, tell him about your goals,how much you’re planning to put down, where you see yourself in the next 5 years, forget about rate, and have them come up with a plan, and options for you to consider. Of course question their responses, and make sure you understand everything their educating you about, but after reading this article my hope is that you no longer look for the “lowest rate”