The latest from the team at Patching Mortgage

What are Pre-Payment Privledges?

Have you ever wondered about Pre-Payment Privileges, how they work, and can be beneficial to pay down your outstanding mortgage amount faster? Watch this movie

What’s the difference between an Insured and a Conventional Mortgage

Believe me, these days mortgages are more complicated than ever before. Depending on your down payment, there’s a variety of different rate options one will

A simpler time

Two years ago I had the honor of hosting a luncheon for 20 of my closest friends at The Vancouver Club to raise money for

How do you Calculate Property Transfer Tax in British Columbia

Watch the Video below to learn how to calculate Property Transfer Tax for your upcoming purchase and as always message me if you have any

Is it possible to be approved for a Mortgage if I’m retired

I find quite often a Co-Signor is required when it comes to someone buying their first property, especially here in Vancouver. A question I get

4 Costs to consider as a first time home buyer

Even if you are the most organized and detail oriented first-time homebuyer you can still overlook some unexpected costs that are a part of the purchase

The one topic Banks don’t talk to you about

Client after client, time after time I hear the same thing…”I had no clue how much it was going to cost to break my mortgage

A Collateral Mortgage?!

Plainly put – A collateral mortgage is one way of registering your mortgage on title. Usually this type of registration is used by banks and

You just bought a home, Congrats! What are your closing costs?

Congratulations you just received an accepted offer, and you are purchasing a home. As the completion date approaches hopefully your Realtor and Mortgage Broker has

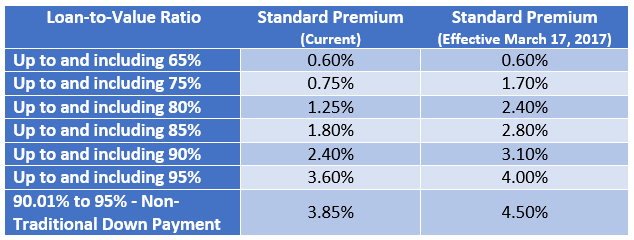

What is Mortgage Insurance

What is Mortgage insurance? Mortgage default insurance protects lenders in the event a borrower ever stopped making payments and defaulted on their mortgage loan. It

The many kinds of Mortgages and the rates that come with it.

OK. You’ve began researching for a mortgage, and what’s the first thing you do? You Google – best rate “fill in the blank of the

Construction Mortgages, and what you need to know about them

So you’re looking to build a new home for you and your family? Or build a home as an investment property? If so, it’s important