The latest from the team at Patching Mortgage

But I have a pre-approval?!

The first step to many when looking for a property is to go to their Bank or BROKER, and ask for a pre-approval. A pre-approval lets

Why Me?

It’s funny anytime you bring up real estate prices with your parents, and they tell you they bought their first home for $150,000 20 years ago. And

Tax relief for First time home buyers

As of February 22nd, 2017 the land transfers tax exception increased its limit from $475,000 to $500,000 for First Time Home Buyers. I’m going to be

Turning Coal into your Diamond – Purchase plus improvements

Have you walked through an open house, and seen a property that’s almost perfect, but may be in need of an update, or a change before

Shopping around for a mortgage? Avoid these six common mistakes

Congratulations, you’ve decided it’s now time to purchase a new home. The first step is to get pre-approved, and look for the perfect mortgage solution

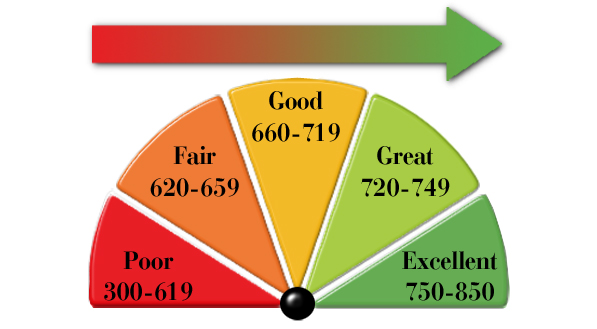

Credit Reporting, and what lenders see

When purchasing, renewing or refinancing your mortgage, your credit score can be the difference between allowing you access to AAA products, and having to go

The BIG 10 – ten steps to owning a home.

Congratulations, you’ve started looking for a place to call home. Let me be the first to tell you, it can/may be overwhelming and stressful. But

Mortgage rules update January 2017

Well, as many of you may know, their’s been some recent changes to the mortgage rules in Canada. I thought it would help if I created a timeline that

What is Bridge Financing

Many sell their current property in order to purchase something new. Reasons may include; need more space, moving locations, etc. Most of the time the

Mortgage Life Insurance Explained

Mortgage professionals like myself can protect our clients, their families and their homes by providing mortgage life insurance policies during the mortgage process. Mortgage life

Top 10 questions asked by FTHB’s

As a first time home buyer, the process of purchasing a home can seem very daunting, especially with the new rules coming into effect today, October