The latest from the team at Patching Mortgage

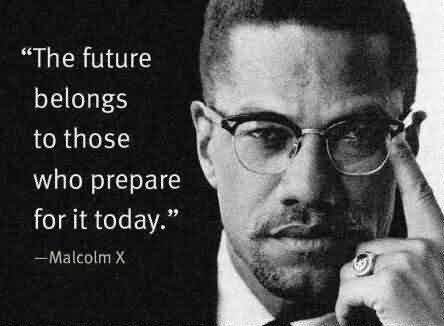

Why put more down if you can

Many First time home buyers lean on their families, social media and the Internet to gather information on how to purchase a home. Most know that they need a

Tips for Paying Off Your Mortgage Faster

More often then not, mortgages in Canada are amortized over twenty five and thirty year terms. I know! Twenty five to thirty years seems like a

Understanding Your Credit Report

People are dependant on credit more and more these days, and therefore, your credit report, and thus your credit rating, has become important in your

What’s a Collateral charge and why you should care

Many lenders (majority of the big banks) are moving towards collateral charge mortgages. Therefore it’s important to understand the differences between a collateral and a standard charge

Keep these in Mind Between Your Mortgage Approval and Funding Dates

As mortgage loans get tougher to secure, as lenders are tightening up their credit underwriting standards, please know that now, more than ever, it’s important to

Revenue Properties

With interest rates as low as they are, now is a great time to invest in revenue properties. Consider starting to buildi your revenue property portfolio or

Pre-Approvals, are they valid?

Good ol Pre-approvals. This term is thrown around in our industry quite often, and many believe that this gives them the right to go out and start

Remember to apply for your Home Owners Grant

Did you know that the average homeowner saves about $600.00 by applying for the home owners grant? On the bottom of your property tax bill which you

Refinancing to pay off debt

Refinancing to pay off debt This article is catered towards current home owners that may be considering refinancing their mortgage in order to free up some money

What to expect at Closing

What to expect at Closing Congratulations! Your financing is approved, and all conditions of your offer to purchase have been completed. You next step is to

How To Make Your Mortgage Interest Tax Deductible

Well aren’t they lucky. Mortgage interest is automatically tax deductible for US home owners. Unfortunately, in Canada, it’s not so easy. In order to make your

Subject Free Offers

With the current state of BC’s real estate market, many potential buyers are being forced to write subject free offers. It’s extremely risky, but a strategy that