Making the switch from renter to homeowner is one of those big decisions you make in your lifetime. It can be a stressful time if you don’t a build a budget plan or start saving prior to the home purchase.

Making the switch from renter to homeowner is one of those big decisions you make in your lifetime. It can be a stressful time if you don’t a build a budget plan or start saving prior to the home purchase.

Budgeting is essential and will help alleviate any stress associated with cash problems that may arise if you purchase a home without knowledge of all the associated costs – including closing costs, down payment, taxes, utilities and ongoing maintenance.

I’ve found that most first-time homeowners neglect to think about their finances, set aside savings or plan a budget.

One should create a realistic budget based on your goals and future plans. Track your spending and make make sure you’re not wasting money on unnecessary items. Budgeting give you a step-by-step formula to best save your money and eventually invest in a home.

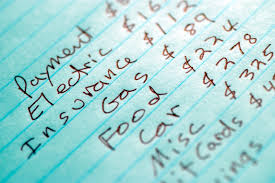

Start by listing your household income/expenses and review your spending habits. Use a pad of paper or on a excel spreadsheet.

Keep your receipts, as this will help you to accurately keep track of where your money is going each month. Then review, and make necessary changes to your savings plan on an ongoing basis.

Examine all areas of your life from entertainment to eating out, where you shop for groceries and clothes. Think about ways that you can cut back your costs, what are your needs, and what are your wants. It’s likely that your wants are the things that are making it difficult for you to save your hard earned money.

Find out where you’re spending a lot of money in one area, set aside an exact amount each month and stop spending money in this area once your budget is all used up. Budgeting gives you the opportunity to re-evaluate your needs and wants.

With your budget in place before you start home or mortgage shopping, you’ll be much more prepared to purchase your first home.

Here are three excellent tips to help you start to prepare for purchasing your first home:

- Set up a savings account. Deposit a predetermined amount into this account each pay period that you will not touch unless it’s absolutely necessary. This money will be for a down payment, cover closing costs, and cover homeownership expenses such as maintenance fees such as, taxes and utilities.

- Save up for expensive items. As your money stacks up in your savings account, you’ll be able to also save for specific purchases such as furnishing your home – avoid temptations like buy now or pay later ads. Wait until you have enough money to spend, and a sale is on. Do your research as all brick and mortars have specific dates that sales will happen each year.

- Assemble your trusted team of professionals. When purchasing your first home, enlist the services of a licensed mortgage professional and a real estate agent. These pros are invaluable to you and will help you through the home purchase and financing processes. They can answer any questions you may have and reduce the stress of the purchase process. Mortgage professionals have access to multiple lenders, and can help get you pre-approved for a mortgage so you’ll know exactly how much you can afford to spend before you start shopping. A real estate agent match’s your needs, with a house you can afford. Both parties negotiate on your behalf to ensure you get the best deal and rate. And, best of all, these services are most of the time free! Both the realtor and mortgage professional can refer you to other reputable professionals you may need for your home purchase, including a real estate lawyer, home appraiser, and insurance broker.

If you have any questions in regard to this article, please feel free to share your comments below, or email me directly at [email protected]

Have a great day!