Only 32% of all mortgage borrowers exercise their contractual right to make significant efforts to accelerate repayments, including taking one or more of the following actions in the past year:

- 16% have voluntarily increased their monthly payments.

- 15% have made a lump sum (balloon payment) contribution to their mortgage.

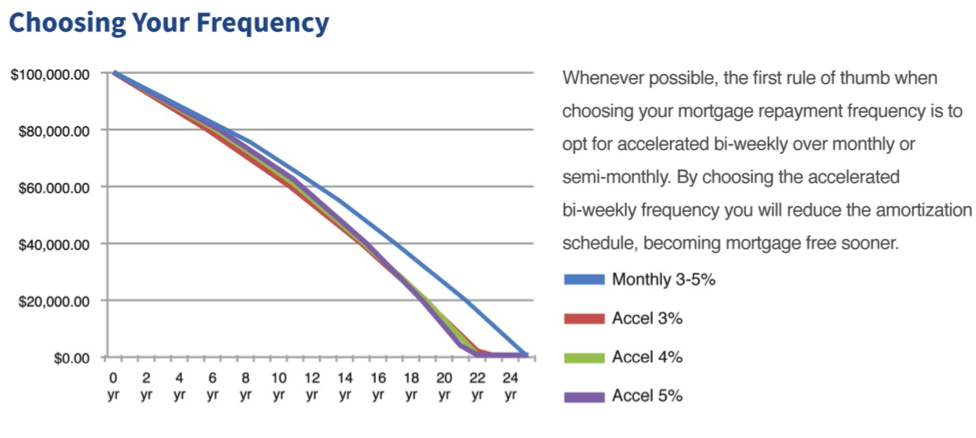

- 6% have increased their payment frequency.

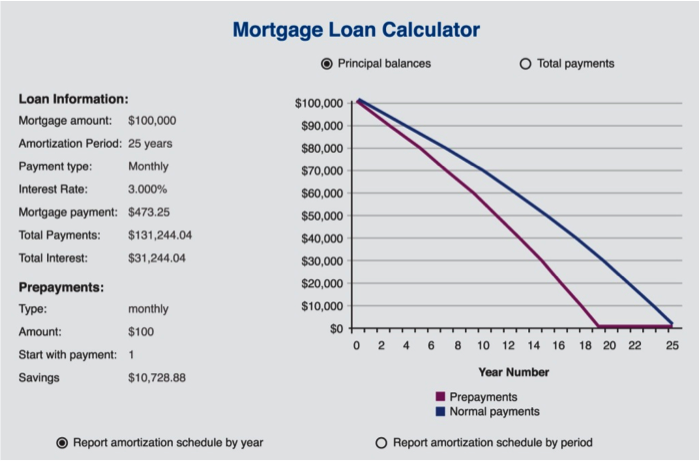

Monthly Increase (extra) Payment

If choosing an accelerated bi-weekly repayment schedule does not work for your plan, then maybe you might be able to consider adding an extra principal payment to your regular monthly mortgage commitment. The graphic below illustrates how the principal amount is reduced when utilizing the monthly increase prepayment option. By adding $100 to your monthly mortgage you can saving $10,729 in interest and reduce the life or the mortgage by 5.9 years.

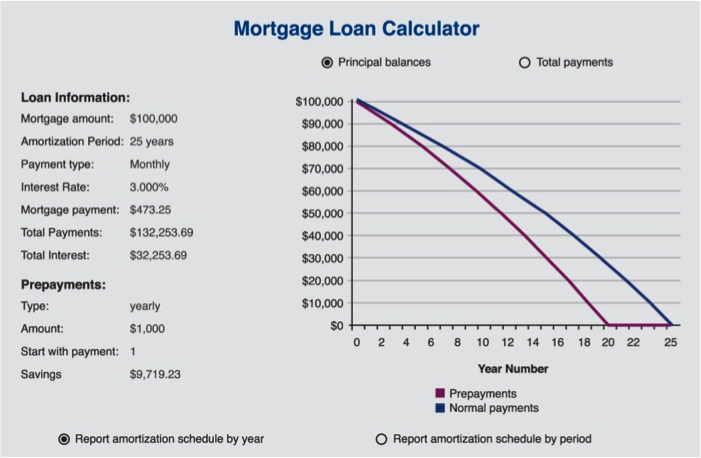

Annual Balloon Payment

The last prepayment option you can utilize to pay down your mortgage sooner is called Balloon payment. You are contractually allowed to pay up to make annual payments on the anniversary date. The graphic below shows a $1,000 balloon payment. An annual contribution of $1,000 will reduce your mortgage by 5.2 years and save you $9,719 in interest.