Many First time home buyers lean on their families, social media and the Internet to gather information on how to purchase a home. Most know that they need a minimum of 5% of the total home purchase price. While this is true, there are a a couple things that family, social media and the Internet may not tell you, or are not aware of.

Try to put down as much as you can. Why? As the media has been stating, mortgage rules are tightening, the economy in Alberta is down because of oil prices and lenders are much more selective in who approve. What you may not have heard is that the top three mortgage insurers – CMHC, Genworth Financial and Canada Guaranty – are also looking at lenders more carefully before approving mortgage default insurance. They evaluate employment, credit score, and how likely one is to stop paying thier mortgage. While 5% is the minimum, if you have a few late payments from back in the day or a collection from a cellphone company on your credit report, the insurance companies will think twice about giving you an approval. However, by putting 10% down, they will look at you differently. Putting twice the minimum down payment shows commitment, proves that you have more invested, and are less likely to default on your mortgage. If lenders and insurers are reluctant to approve your mortgage, a higher down payment will help.

A second advantage of a larger down payment is lower monthly payments. Let’s be honest, when you finally save enough, and move into your home, your car will eventually need to be replaced, and you will now have car payments and repairs chipping away at your monthly income. What about if you are newly married? Child care expenses, and baby furniture is expensive. You may be able to afford higher monthly payments, but you’ll be much better off in the future if you have lower monthly payments.

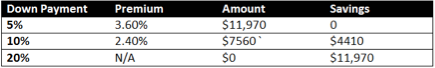

The third advantage is a lower CMHC premium rate. The larger your down payment, the lower the risk to the mortgage insurer, and the rate they charge you. With 5% down you must pay 3.60% on the mortgage balance. On a home purchase of $350,000 this comes out to a premium of $11,970. Wow!!!

10% down results in a lower premium of $7560 and if you can make a 20% down payment you can avoid mortgage default insurance all together, and pay $0. Now that sounds better doesn’t it?!

Finally, the larger the down payment, the smaller the mortgage balance is to start. You save much more money over the term of your mortgage.

A 5% down payment will result in a payment of $115,381of interest over 25 years. 10% down brings it down to $108,042 and 20% down lowers this to $93,786.

So…. if you put down a 20% down payment, you will save over $21,000 in interest over the term of your mortgage (based on today’s historically low interest rates, and is subject to change).

Let me leave you with this, if you have the ability to put more money down on the purchase of your new property, DO IT. You can save TONS of money by doing so.

Please do not hesitate if you have any questions.

All the best,

D