Welcome 2024!

Is this the year we start to see a dip in interest rates? In short, the Bank of Canada should reduce rates. The market’s magic 8-ball now shows 5-6 target rate cuts in 2024, but I’ll believe it when I see it, and continue to keep you in the loop as much as possible.

Know that the Banks message will continue to say, ”we’re still considering increasing rates if inflation is not at 2%”, but that’s just to reduce inflation expectations (ie, people not believing that rates will drop) in hopes to deter premature rate celebrations and home-buying exuberance.

As it’s a new year I thought it would be helpful to share four factors that I believe will affect our interest rates in 2024.

1. Inflation:

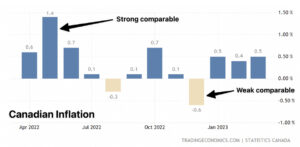

A majority of the G20 countries are disinflating, but Canada has at least two more upcoming inflation results to be fearful of:

- December CPI – Compared to most months of the year in 2022, December’s CPI was low. This is because we were in the thick of it last year with everything being more expensive than it ever has been and people being tight with their budget. Therefore, when we compare this years numbers to last, they may not look too favorable. The report to be released on January 16th. The BoC is aware of this though, and once we’re past this report, hopefully the following months will be more favourable.

- On the bright side, due to the massive increase in rate hikes throughout 2023, housing costs have skyrocketed, which will limit peoples spending and increase unemployment past 6%, which will decrease GDP in 2024. Fingers crossed, CPI is well below 3% mid way through 2024.

- Housing inflation

- U.S. GDP

- AI – taking jobs away from people seeking work, or work forces not needing to run at the same capacity and therefore firing people

- Oil prices

- ANY inevitable global/economic surprises that could affect the supply and demand of our goods

- This is the spread between the banks rate, and what they offer their clients (YOU), and lucky for us, bank credit spreads have been better than expected. S&P Global U.S. measure (there’s no equivalent Canadian measure) shows them approaching 2023 lows, meaning traders expect less risk for large banks. If this trend continues, banks may offer lower rates, especially with their variable discounts.

What goes up, must come down, and even though we’ve had a good run where the right numbers are moving in the right direction, if history repeats itself, our inflation numbers throughout 2024 will not be a straight line. Therefore, don’t be overly concerned if we see some higher Inflation numbers in the months ahead. Before inflation gets back to 2%, we’re likely to see:

- Multiple technical bounces in yields — which is usually just noise, but it’s often disconcerting noise

- Economic surprises — which will change the scope of when the market believes rates will be reduced

For rates to keep trending down, we need bad news in the headlines.

4. Competition

As the volume of mortgages decreases due to a majority of people holding onto their current rate, banks will need to compete for business. This will force Banks and Lenders to discount their rates in hopes to entice people back into the market.

- 2024 BC Assessments are out – Here’s a link. Please note, the lower the value of your home, the better, as this number is what your property tax bill will be based on. Also note, the assessed value is NOT the true value of your home. Just ask your trusted Realtor, or if you don’t have one, I’m happy to put you in contact with someone.

- Investment opportunity: people who like Dividend stocks: if history is a guide and the BoC cut rates as expected, mortgage stocks should go on sale in 2024 (drop in price). In the last few decades, the optimal time to buy mortgage lender stocks has been just before or after the last BoC rate cut. Please note that I am not a Financial Advisor, so please take this point with a grain of salt, and invest wisely.

Please feel free to share this with anyone you feel would benefit from reading this, and reach out anytime if you have any further questions, comments or concerns.